The 2022 electric car purchase incentives come at a very particular time. In fact, they come almost in conjunction with the European decision regarding 2035 as the deadline for the production and sale of endothermic-powered cars.

If you are also thinking of buying a new car by taking advantage of the 2022 electric car bonus, this article is for you!

The Draghi government recently made official the allocation of 650 million euros for each of the years 2022-2023-2024. Somme cherientrano among the resources approved in the Automotive Fund, for which a total budget of 8.7 billion euros has been set aside until 2030.

But how do the incentives for buying electric cars work?

First of all, it should be specified that, as in past years, it is the responsibility of dealers to book grants for the purchase of new, non-polluting vehicles, cars and motorcycles. To do so, sellers use the official platform managed by Invitalia, also handling the bureaucratic rigmarole for vehicle registration.

Therefore, the buyer is not required to take any direct action to obtain government incentives. Certainly, however, it is advisable to be aware of the parameters under which the purchase of a new vehicle can take place with the application of the incentives.

Reason why we will elaborate in this article:

- What are the emission ranges established by the incentives?

- How does scrapping work to receive incentives?

- What are the spending limits under the incentives?

- Why do the incentives only apply to individuals?

- What are the latest electric car models for 2022?

- August 2022 update on incentives for buying electric cars

- Are there incentives for the purchase of the charging station?

What are the emission ranges established by the incentives?

First, why do we talk about emission bands for the disbursement of 2022 electric car bonuses?

There are different amounts that are allocated to different categories of vehicles.

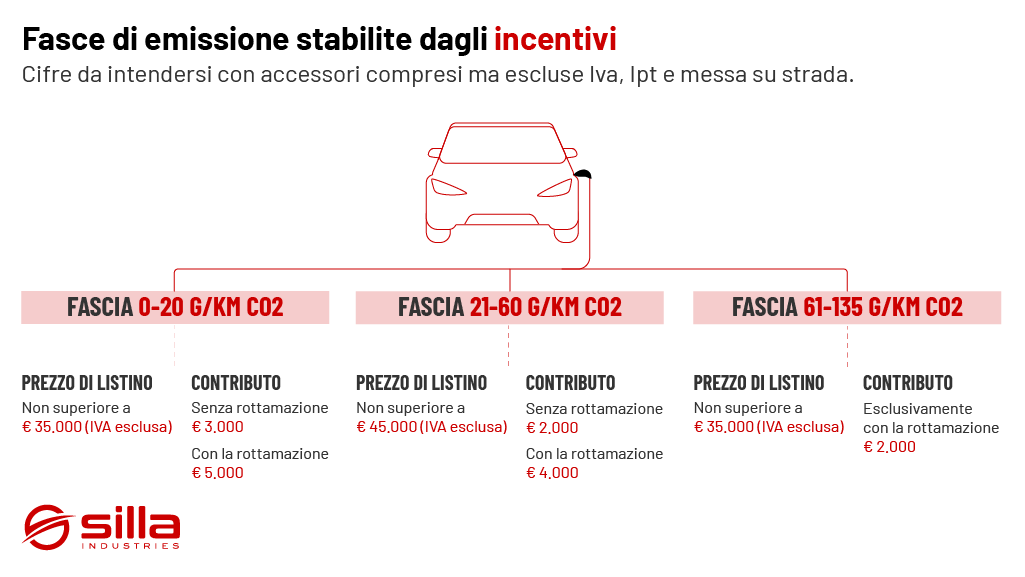

The discriminating variable is CO2 emission in g/km relative to the car’s list price. Of course, electric (zero-emission) cars are entitled to cheaper rebates, just as non-electric cars have access to lower subsidies. To these parameters will be added the presence or absence of the vehicle to be scrapped.

Here is the detail*:

- For the 0-20 g/km CO2 range, the list price must not exceed €35,000 (excluding VAT) and the subsidy is €3,000 without scrapping and €5,000 with scrapping.

- For the 21-60 g/km CO2 range, the list price must not exceed 45,000 euros (excluding VAT) and the subsidy is 2,000 euros without scrapping and 4,000 euros with scrapping.

- For the 61-135 g/km CO2 range, the list price must not exceed 35,000 euros (excluding VAT) and the subsidy is 2,000 euros exclusively with scrapping.

*Figures to be understood with accessories included but excluding Vat, Ipt and road commissioning.

How does scrapping work to receive incentives?

The scrapping of a vehicle is a plus in obtaining benefits for the purchase of a new car. Specific requirements have also been imposed for this item.

The scrapped vehicle must be of a category less than Euro 5, and it must also have been owned by the person applying for the incentive for at least 12 months on the date of application for the incentive. Alternatively, the car to be scrapped may be owned by a cohabiting family member, again for at least 12 months.

A completely new element compared to previous years is that the car purchased with the economic benefits and financing must remain the property of the incentive applicants for at least 12 months.

What are the spending limits under the incentives?

One aspect retained from past years is the maximum spending limit on the car to be purchased. The spending limit changes depending on the band we are referring to. As we said before, the figures applied to the bands did not include vat, ipt and road commissioning. By adding only vat the spending limits become:

- 42,700 euros for the 0-20 g/km CO2 range

- 54,900 euros for the 21-60 g/km CO2 range

Why do the incentives only apply to individuals?

The incentives are aimed only at individuals, excluding companies operating in car sharing, although that to exclude business buyers (e.g., companies getting electric corporate fleets) is a decision that has stirred much controversy.

Why do incentives not apply to companies?

In previous rounds much criticism had been levelled at incentives absorbed by companies at the expense of the individual buyer. A problem that will not exist this year, although opinions are controversial on this point.

What are the latest electric car models for 2022?

So, now you know what the incentives are and how they work but what are the electric car models released or coming out for the year 2022? Here we leave you with a multibrand overview of what’s new on the list. Wherever your charging preference falls, no problem, we’ve got you covered. In fact, Prism is the universal charging station for charging your home car, in both Basic and Solar versions.

August 2022 update on incentives for buying electric cars

The summer has brought interesting opportunities in addition to the existing initiatives to support the purchase of non-polluting cars that we have explained in this article.

Under the new measures, which will be formalized by the appropriate decree in the coming weeks, those with incomes below 30,000 euros will be eligible for a 50 percent extrabonus.

In terms of figures we are talking about 4,500 euros without scrapping and 7,500 with scrapping for electric cars, and for hybrids 3,000 euros without scrapping and 6,000 with scrapping.

Are there incentives for the purchase of the charging station?

Staying on the topic of incentives… what happened to those for the purchase of the electric car charging station?

Many of you have asked us, and we can finally give you good news: they are back! In this article we explain in more detail what they provide and who they are aimed at.